Asset Classes & Base Portfolios

Odingard Capital Management believes that an actively managed diversified portfolio of multiple asset classes can deliver better long-term risk adjusted performance than other investment styles such as mutual funds, funds of funds, ETF managers, and managers of managers. We only design and manage multi-asset class Separately Managed Accounts (SMAs). The distinct equity SMA we design and manage for you will never include complex, expensive, and poorly correlated mutual or bond funds.

Because the portfolios we build consist solely of individual equities, our Clients have clarity on what stocks they own, how their portfolio is performing, and how we are paid. That is highly unusual in today's managed fund world where most people don't readily know what they are holding, or how much they pay in disclosed and hidden fees.

Equities

OCM's Investment Management team uses a three-stage discipline to actively manage this asset class.

The Equities asset class consists of 35-45 individual holdings. The team quantitatively screens a large universe of companies to isolate higher quality and higher growth companies.

Target characteristics include high quality earnings, clean balance sheets, seasoned management capable of driving higher economic margin, and a maximum ask price of 80% to book.

The Equities asset class is used for growth in a customized LISA multi-asset class portfolio.

Fixed Income

OCM's Investment Management team uses a three-stage discipline to actively manage this asset class.

The team uses a modified laddered approach to capture what they believe are the best combination of yield, maturity, and duration using typically high quality individual bonds.

The Fixed Income asset class is used for income generation and risk reduction in a customized LISA multi-asset class portfolio.

Natural Resources

OCM's Investment Management team actively manages this asset class with allocations to three subclasses.

Depending on the team’s fundamental conclusion on the future level of inflation, and fundamental opinion of the subclasses, the team strategically allocates to commodities, energy, and alternative energy.

The Natural Resource asset class is used for an inflation hedge, growth, and the lower correlation to other asset classes.

Real Estate

OCM's Investment Management team analyzes the macro and micro aspects of the global real estate market to first isolate a macro overweight, neutral, or underweight stance on the asset class.

Next, the team targets allocations to domestic versus international real estate. Third, on a micro basis, the team selects individual issues such as common stocks, REITS and/or exchange traded funds in both commercial and residential real estate.

The Real Estate asset class is used for its income generation potential and lower correlation to other asset classes.

Alternatives

OCM's Investment Management team uses a three-stage discipline to actively manageX this asset class.

Depending on the customized asset allocation, positions are used to either hedge currency, interest rates, and volatility, or to provide exposure to sub-asset classes such as private equity.

The Alternatives asset class is used for hedging, risk reduction, and growth in a customized LISA multi-asset class portfolio.

Base Portfolio Models

Following CFA Institute guidelines, your Portfolio Counselor and our Investment Management team create a customized Investment Policy Guideline (IPG) suited to your individual needs. The IPG includes information obtained during meetings, along with permitted ranges and targets for each actively managed LISA asset class. The IPG confirms you and the investment team agree on the proper asset allocation and variables. Once the IPG is signed by you and a member of our Investment Team, the portfolio construction begins. Depending on market conditions in each asset class, along with capital gains considerations, your portfolio will be typically constructed over the course of four months. Your portfolio is built to your customized IPG that details objectives, risk tolerance, and timeline.

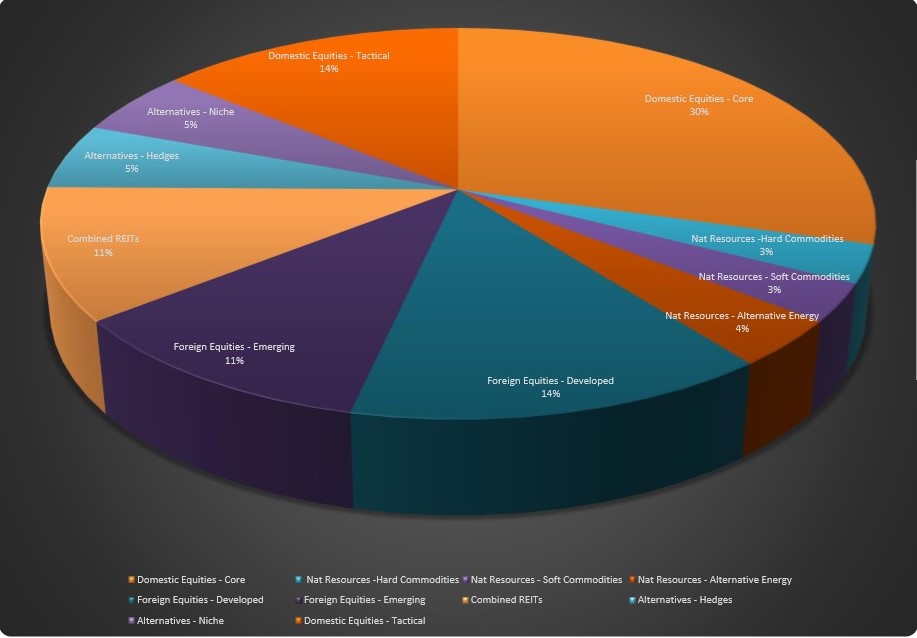

These model portfolios represent the baseline allocation. Your portfolio will likely be a blend of one or more of the baseline allocations, depending on your objectives, risk tolerance, and timeline.

Depending on the information you provide on your Investment Policy Guideline (IPG) which details your objectives, risk tolerance, and timeline, your portfolio could resemble this simulated allocation.